- Protect Your Family

- Compare Multiple Life Insurers

- IRDA Authorised Agents

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Reviewed By:

Raj Kumar has more than a decade of experience in driving product knowledge and sales in the health insurance sector. His data-focused approach towards business planning, manpower management, and strategic decision-making has elevated insurance awareness within and beyond our organisation.

Updated on Aug 07, 2023 4 min read

How To Revise HDFC Life Insurance Policy Online?

Relocation has become a common phenomenon in the present time. It might be due to transfer in a job or any other reason. The moment one chooses to move from one place to another the contact details and the mailing address change with the relocation.

The present generation is blessed to have online services that help them Revise the current information. In earlier times one had to take time and go to the particular zonal office to get data changed after the approval of the higher officials. But things have become hasslefree over time.

Here we have got for you a few steps following which can help you revise your HDFC Life details online whether it is personal or address details.

How To Change Personal Details in HDFC Life Insurance Policy?

The personal details should be revised in case of any changes. The personal details play an essential role in the functioning of the policy during the policy tenure at the time of claim. Any discrepancy or mismatch in the data can lead to rejection of the claim.

- Login to your HDFC Life account on the official site of HDFC Life Insurance (www.hdfclife.com)

- After login, you will find ’My Profile’ at the top of the page. Click on the arrow mark on beside the ’My Profile’ option.

- Click on the personal details tab.

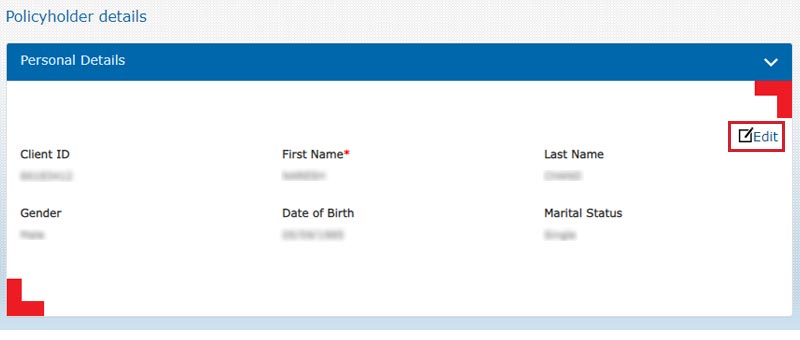

- On the new page, you can find your details like client ID, name, gender, marital status, date of birth. On the right-hand side of the pop-up window, there is an ’Edit’ option. Click on ’Edit’.

- Do the HDFC Life insurance personal details revise according to you.

- Click on the ’Submit’ option at the base of the tab.

The permanent address is considered to be more stable and does not change so frequently. But, in case you move permanently to some other place, it is always safe to revise the details in all your official documents. For HDFC life insurance here are the steps you can follow to revise your details on the online portal at your convenience. Relocation is a common activity observed in the present scenario. In such a case, official documents need to be revised accordingly. It becomes mandatory in case of insurance and investments done by you. Every detail needs to be revised according to the current communication address.

Life Insurance Companies

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies.

In Case Of HDFC Life Policy Address revise

- Click on a red arrow symbol beside your name on the right-hand side of the page. Click on the ’Communication Address Details’ tab or ’Permanent Address Details’ tab as per HDFC Life revise you want to make.

- On the new page, you can find your details like house no/flat no., street address, area landmark, country, state, city, pin code. On the right-hand side of the pop-up window, there is an ’Edit’ option. Click on ’Edit’.

- Changes are to be made accordingly.

- Click on the ’Submit’.

In case of theft, you lose your contact number and get a new one then it is to be revised in the contact details of the life insurance company you withhold. Here are a few steps following which you can replace the old contact number with the new one on the online portal of the life insurance company.

How To revise Contact Details in HDFC Life Policy?

- After login click on the ’Contact Details’ tab under the ’My Profile’ tab.

- On the new page, you can find your details like email ID, mobile number, telephone home, telephone office, alternative mobile, alternative email ID. On the right-hand side of the pop-up window, there is an ’Edit’ option. Click on ’Edit’.

- Do the HDFC Life contact revise according to you.

- Click on the ’Submit’ option.

In Case HDFC Life Bank Account Details Revise

Bank account details can be easily revised with the hasslefree steps mentioned below.

- Click on the ’NEFT Details’ tab under the ’My Profile’ tab after login.

- On the new page, you can find your details like account holders name, account number, account type, etc. On the right-hand side of the pop-up window, there is an ’Edit’ option. Click on ’Edit’.

- revise the new account number.

- Click on the ’Submit’ option to proceed.

Why Do You Need To revise Beneficiary Detail?

The nominee is considered to be the whole and sole owner of the death benefits after the death of the insured. So, it is always necessary to mention a nominee in your life insurance policy. Not only this, but you should also intimate the nominee about the policy so that the nominee can act accordingly at the time of need. If you have not added a nominee in your policy you can do so now following the below-mentioned instructions.

How To revise HDFC Life insurance Nominee Details Online?

If You Want To Add HDFC Life insurance Beneficiary

A nominee is optional, still, if you want to add a nominee into your policy so that s/he can get your after death benefit, then you can follow the following step to add one.

- Go to the official site of HDFC life insurance.

- Login to your account.

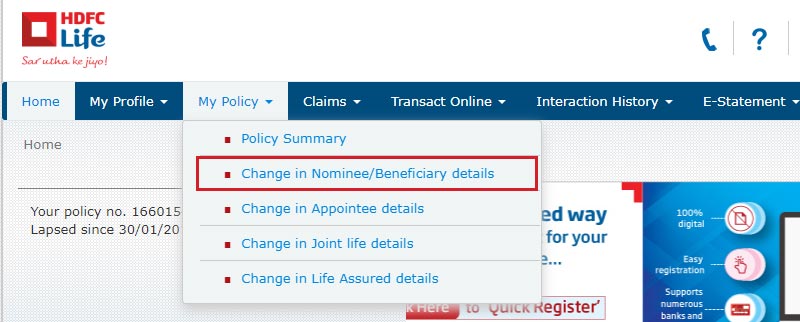

- On the top of the HDFC Life insurance page, you will find a tab ’My Policy,’ click on the tab.

- Several tabs will pop out once you click on ’My Policy’. Go to tab ’Change in Nominee/Beneficiary Details’ and click.

- The new page shows all the policies bought by you in the column form.

- Click on the HDFC Life insurance policy number for which you want to change the beneficiary/nominee details.

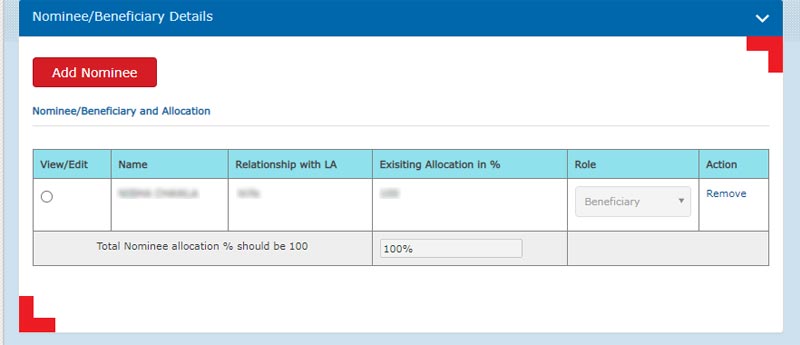

- Scroll down on the new page to view the old nominee name in the column form.

- On the top of the column, a red tab will appear ’Add Nominee’. Click on this.

- The moment you click on ’Add Nominee’, below the column, a tab will appear ’Select Nominee’.

- Click on ’Select Nominee’.

- Go to ’Others’.

- Fill in the detailed information of the nominee you want to be.

- Click on ’Save Nominee’.

In case you want to revise the HDFC Life nominee then it has become easier now as you can do that online sitting at home. Here are the steps you can follow to do the same.

For HDFC Life Nominee revise

In case you want to bring changes in the name of the nominee so that the claim process is smooth and easy, here are the guidelines to help you:

- Go to the tab ’My Policy’.

- Several tabs will pop up once you click on ’My Policy’. Go to tab ’Change in Nominee/Beneficiary Details’ and click.

- The new page shows all the policies bought by you in the column form.

- Click on the policy number for which you want to change the beneficiary/nominee details.

- Scroll down on the new page to view the old nominee name in the column form.

- In the last column, there is an option ’Remove’. Click on the tab and remove the nominee you had appointed earlier.

- Click on the red tab ’Add Nominee’.

- Got to Select ’Nominee Tab’. and click on ’Others’.

- A form for detailed information of the nominee will appear. Fill in the details.

- Click on the ’Save Nominee’ tab at the base of the nominee application form once you have filled in all the details.

How Can revise Policy Details Offline?

If you want your HDFC Life details to be revised offline then it can be done in three ways:

- Contact Customer Care Executive: Customer care service is provided by the HDFC life insurance company. For HDFC life revise relating name, beneficiary name, address or contact details, feel free to contact on 1860 267 9999. The customer care executive will help you out with all your queries.

- Email Your Query: The queries regarding HDFC life revise in details can be emailed to service[at]hdfc[dot]com. Satisfactory guidance will be provided to the policyholder by the HDFC life chat support person.

- Visit The HDFC Life office: In the case of unavailability of the above-mentioned facilities, the policyholder is free to move to the HDFC Life Insurance office and will surely get the assistance from the HDFC Life insurance staff.

Earlier the insurance details revise procedures were complicated as well as slow. The monotonous time-consuming activity has been replaced with the colorful company’s login portals. It is always beneficial to grow with time in all aspects. So, do HDFC Life registration and get ready for online access. Do HDFC Life policy detail revise at your ease.

Life Insurance Companies

Share your Valuable Feedback

4.6

Rated by 855 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Himanshu Kumar

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

Do you have any thoughts you’d like to share?